are donations to election campaigns tax deductible

Simply put political contributions are not tax-deductible. But does not involve any campaign contributions.

The Complete Political Fundraising 2022 Guide Numero Blog

Political Contributions Are Tax Deductible Like.

. Hence the answer is no contributions to political candidates are not tax-deductible on your personal or business tax return. While political contributions arent tax-deductible many citizens still donate money time and effort to political campaigns and to support political candidates. While political contributions arent tax-deductible many citizens still donate money time and effort to political campaigns.

Things To Know. The IRS tells clear that all money or effort time contributions to political campaigns are not tax deductible. Though political contributions are not tax-deductible many people still willingly spend their money on the election campaign.

A donation will be tax-deductible if the campaign creator has indicated that they are a registered charity when creating their campaign. People love to support their favorite candidate. When it comes time to file taxes though many people may not fully understand what qualifies as a tax deduction.

This donation pays for the Capitol Hill legislative analysis and information center videos and. If you contribute to a candidate or political campaign you may be wondering are donations to political campaigns are tax-deductible. On the part of the candidate to whom the contributions were given Revenue Regulations 7-2011 provides that as a general rule the campaign contributions are not included in their taxable income.

1500 for contributions and gifts to independent candidates and members. The answer is no political contributions are not tax deductible. Its only natural to wonder if donations to a political campaign are tax deductible too.

The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations. The answer is simple No. So if you support your favorite candidate you.

Its easy to give online. Americans are encouraged to donate to political campaigns political parties and other groups that influence the political landscape. Are Charity Donations Tax Deductible.

Arkansas Ohio and Oregon offer a tax credit while Montana offers a tax deduction. Arkansas residents can get a 50 tax credit per taxpayer so 100 for a couple filing a joint return for cash contributions made by the taxpayer in a taxable year to one or more of the. Wrongfully claiming political contributions can and will attract the attention of the Internal Revenue Service and can lead to an assessment of additional taxes due penalties and interest.

Are Political Donations Tax Deductible. They give their time effort and support to the candidates and their parties. An individual donor can donate as much as 2900 per election to a candidate committee.

Zee March 2 2022 Uncategorized No Comments. Only those donations or contributions that have been utilizedspent during the campaign period as set by the Comelec are exempt from donors tax. This is provided under the Omnibus Election Code OEC and Republic Act 7166.

If you decided to donate money or time or effort to political campaign you might wonder whether political contributions that you make are tax deductible. Are Donations to Political Campaigns Tax Deductible. However contributions given to candidates or political parties will not be subject to donors tax.

Despite the fact that political donations are exempted from tax deductible status a limit is imposed by the federal law for political donations. Below we provide a list that IRS says is not tax deductible. Federal political contributions are donations that were made to a registered federal political party or a candidate for election to the House of Commons.

You can receive up to 75 percent of your first 400 of donation as credit followed by 50 percent of any amount between 400 and 750 and 333. It doesnt matter if it is an individual business or other organization making the donation the campaign contribution is not deductible. Furthemore the same goes for campaign donations.

Political contributions deductible status is a myth. If you are one of those citizens and you were hoping for a tax break unfortunately you wont find one here. Is a 501c3 organization with an IRS ruling year of 2009 and donations are tax-deductible.

Qualification and registration fees for primaries as well. The most you can claim in an income year is. You need to claim your tax deduction for a political contribution or gift in the income year you made the contribution or gift.

Donations are tax-deductible if the campaigns beneficiary has 501 c 3 status with the IRS. 1500 for contributions and gifts to political parties. If youre looking to save more on your taxes this year find out if youre eligible for any of these 10 most.

This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible. Donations utilized before or after the. You cannot deduct expenses in support of any candidate running for any office even if you are spending money on your own campaign.

Depending on the campaign creators location conditions may apply. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates. The answer is no donations to political candidates are not tax deductible on your personal or business tax return.

All campaigns on LaunchGood that are created by a registered charity. Claiming a Credit for Federal Political Contributions. Donations utilized before or after the campaign period are subject to donors tax and not deductible as political contributions on the part of the donor.

There are a few ways to tell if a campaign is tax-deductible. The federal government allows various deductions that can help reduce your taxes but this does not include your political contributions to the campaigns of any organization or individual. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible.

While tax deductible CFC deductions are not pre-tax. The IRS states You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. Unlike charitable donations which are tax deductible donations to a political party or PAC are NOT tax deductible.

Advertisements in convention bulletins and admissions to dinners or programs that benefit a political. Under the Omnibus Election Code contributions in cash or in kind to any candidates political parties or party-list groups are exempt from the imposition of Donors Tax. The same goes for campaign contributions.

The Complete Political Fundraising 2022 Guide Numero Blog

Power Your Political Campaign With Give Givewp Fundraising

Pro Trump Nonprofit Gives Millions To Groups Boosting His Agenda Center For Public Integrity

Money And Campaigning Review What Do Pacs Do Electioneering Give Money To Candidate Help Get Elected Once Elected Support Policies Or Political Ppt Download

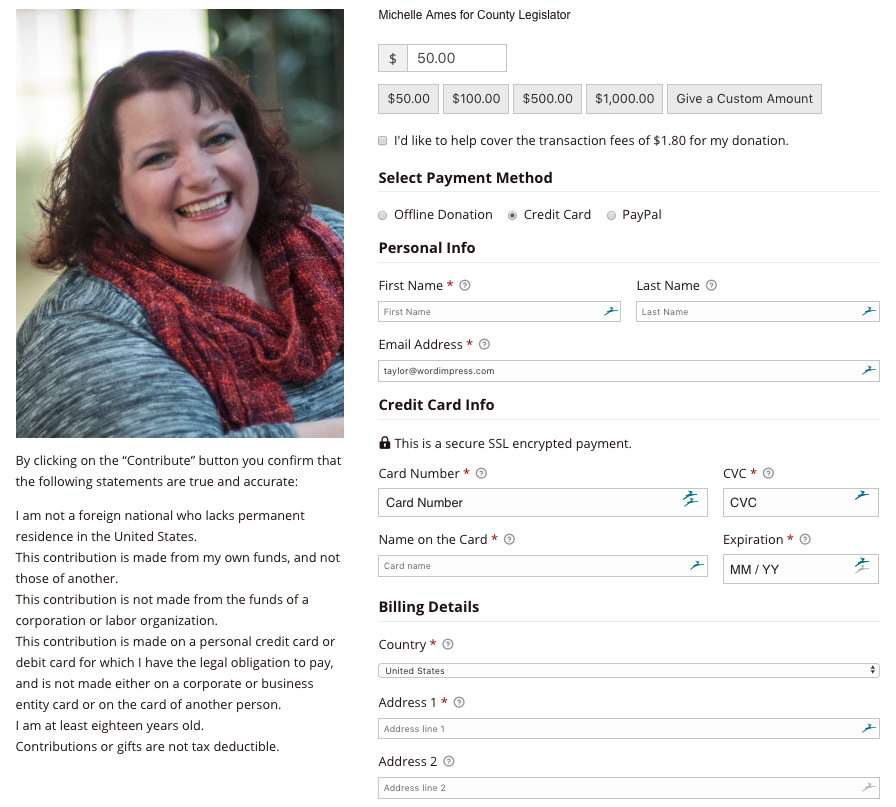

Contribute Village Republican Women

Money And Campaigning Review What Do Pacs Do Electioneering Give Money To Candidate Help Get Elected Once Elected Support Policies Or Political Ppt Download

Events Peter Kopsaftis For Congress

Money And Campaigning Review What Do Pacs Do Electioneering Give Money To Candidate Help Get Elected Once Elected Support Policies Or Political Ppt Download

Are Political Contributions Tax Deductible Thestreet

Power Your Political Campaign With Give Givewp Fundraising

5 Local Victories For Democracy That Passed On Election Day Greenpeace Usa

Money And Campaigning Review What Do Pacs Do Electioneering Give Money To Candidate Help Get Elected Once Elected Support Policies Or Political Ppt Download

Power Your Political Campaign With Give Givewp Fundraising

The Complete Political Fundraising 2022 Guide Numero Blog